Smart Operational Risk Management for Third-Party Compliance

Identify, assess, and mitigate operational risks from third-party relationships while maintaining resilience and regulatory compliance.

<10 Days

Risk assessments

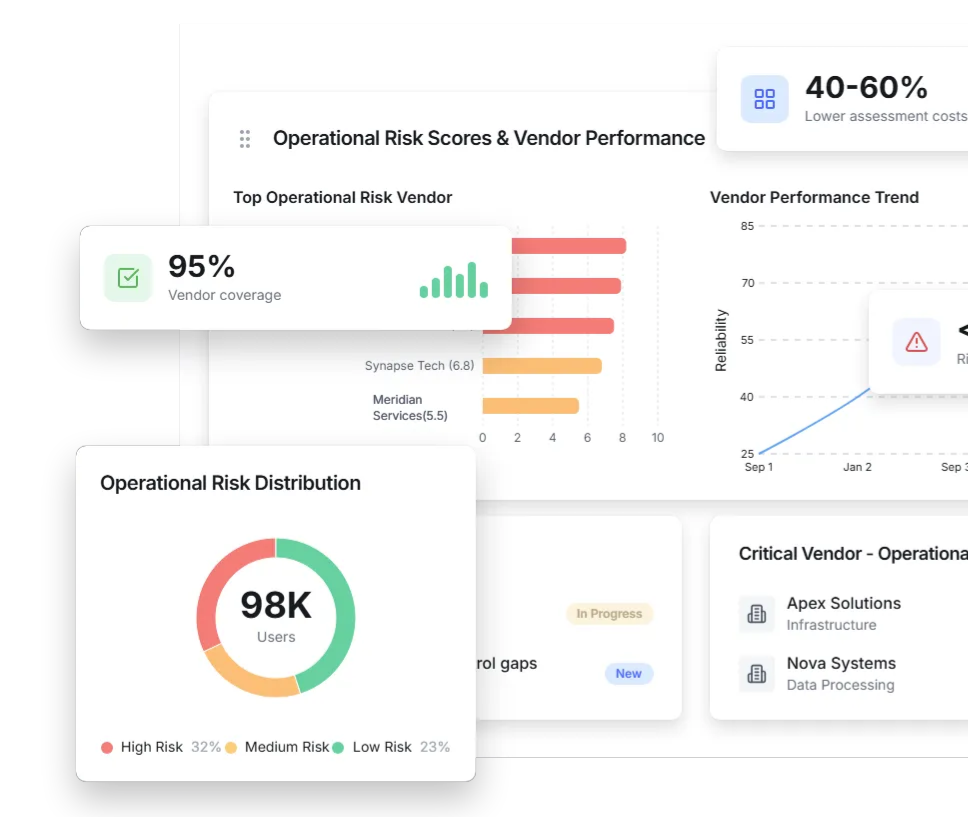

Up to 95%

Vendor coverage

40-60%

Lower assessment costs

Trusted partner to market-leading brands

Continuous risk identification

Analytics-driven prioritization

Identify and Assess Risks Proactively

Gain deeper insights into vulnerabilities through continuous risk identification and assessment across your third-party relationships. Prioritize risks and allocate resources effectively using analytics that show which vendors pose the greatest operational threats. Ensure compliance with industry standards by understanding how third-party operations impact your ability to deliver services and safeguard critical assets.

Align review depth with vendor risk, compliance requirements, and impact.

Real-time tracking

Accountability enforcement

Monitor Vendor Performance

Maintain oversight of third-party performance to ensure compliance and alignment with your business objectives. ComplyScore®’s advanced monitoring tools help track vendor reliability, operational consistency, and adherence to contractual obligations. Identify performance gaps before they become critical failures and enforce vendor transparency through structured accountability mechanisms.

Get real-time visibility into vendor performance and SLA adherence.

Disruption management

Contingency planning

Ensure Resilience and Continuity

Minimize disruptions and ensure your organization remains resilient despite vendor failures or market uncertainties. Reduce financial losses by proactively managing disruptions before they impact operations. ComplyScore® ensures uninterrupted service delivery through contingency plans that activate when third-party issues emerge. You gain competitive advantage through stability and reliability in vendor relationships.

Keep critical services running, even when third-party disruptions hit.

Proactive risk mitigation

Stakeholder trust

Safeguard Financial and Reputational Assets

Reduce the likelihood of costly incidents, regulatory penalties, and reputational damage through effective operational risk management. ComplyScore®’s proactive approach avoids regulatory fines, operational downtime, and financial losses that stem from third-party failures. Build credibility with stakeholders through rigorous due diligence and compliance practices.

Turn operational risk into measurable financial and compliance confidence.

Transform Your TPRM Program

Conduct Risk-Based Due Diligence

Proven Results Across Industries

Trusted partner to market-leading brands

Atlas far exceeds our requirements...

One of the key differentiators between Atlas and other governance, risk and compliance and 3rd party risk management tools is the ease of use of the Atlas solutions. Also from a total cost of ownership perspective, Atlas far exceeds those requirements in terms of being very cost efficient in delivering all this.

Izhar Mujaddidi,

Senior Director, Cybersecurity, Carelon Behavioral Health

ComplyScore is highly responsive and adaptable

ComplyScore is highly responsive and adaptable to our evolving processes and requirements, proving to be a trusted partner at every step. Their security analysts were knowledgeable, flexible, and delivered exceptional services that consistently exceeded our expectations.

Enterprise Client

G2 Review (Jan 2025)

My experience has been largely positive

I have been using ComplyScore for several months and my experience has been largely positive. The platform provides comprehensive solutions for compliance management and streamlines our operations efficiently.

Mid-Market Company,

Gartner Peer Insights (Sep 2024)

Trusted by Industry Leaders

Representative Vendor | Listed in 2025 Market Guide for TPRM Technology Solutions

Active partner member of the Third Party Risk Association

Trusted across healthcare, financial services, technology, and regulated industries

See ComplyScore® in Action

Book a 30-minute walkthrough showing how Atlas Systems' certified analysts will execute your assessments, monitor your vendors, and coordinate remediations on the ComplyScore® platform.

Quick Answers

How does ComplyScore® help me identify operational risks from third parties?

You gain continuous visibility into how third-party operations impact your service delivery, compliance posture, and critical assets. ComplyScore® provides analytics-driven risk assessments that prioritize vendors by operational threat level, enabling you to allocate resources where they'll have the greatest impact on resilience.

What types of vendor performance issues can I monitor?

You track vendor reliability, operational consistency, and contractual compliance in real time. ComplyScore® identifies performance gaps, service disruptions, and compliance failures before they escalate into critical issues that affect your operations or regulatory standing.

.png?width=387&height=387&name=image%20(5).png)